You are here

July startup expected for 800-MW Ohio gas plant

Oregon Clean Energy Center, one of the first new combined-cycle natural gas projects that launched Ohio's shale gas-fueled generation buildout nearly three years ago, is about ready to start producing electricity commercially.

"It looks like the plant will be online in the next couple of weeks," William Martin, president of CME Energy, the Boston-based developer, said in a Tuesday interview about the 800-MW facility near Toledo in northwest Ohio.

And it will not be the last combined-cycle gas plant to be built in the Midwestern state, in the opinion of Martin, a veteran developer who has built power plants in the US and around the world.

Martin does not subscribe to the theory of some analysts who say recent low clearing prices in PJM Interconnection's capacity auction could sound the death knell for the nascent gas buildout across the PJM region, which includes 13 states plus the District of Columbia.

In fact, he envisions a potential opportunity to add another 20,000 MW of gas-fired generation in the region as older coal and nuclear plants, unable to compete with cheaper gas and

renewables, retire in the coming years.

It all sort of started with Oregon Clean Energy Center and a couple of other early movers in Ohio.

Black & Veatch, the engineering, procurement and construction contractor, began work on the approximately $900 million plant in November 2014.

B&V is going through its final checklist for the plant and an early July startup is anticipated. "We're very optimistic we'll have a closing soon," Martin said. "There's paperwork they have to go through."

Another plant proposed for Toledo area

Martin also is a 50% partner with longtime colleague William Siderewicz in Clean Energy Future Oregon's 955-MW Oregon Energy Center combined-cycle gas plant, also proposed for the Toledo area.

That project is still progressing through regulatory channels and is not yet under construction.

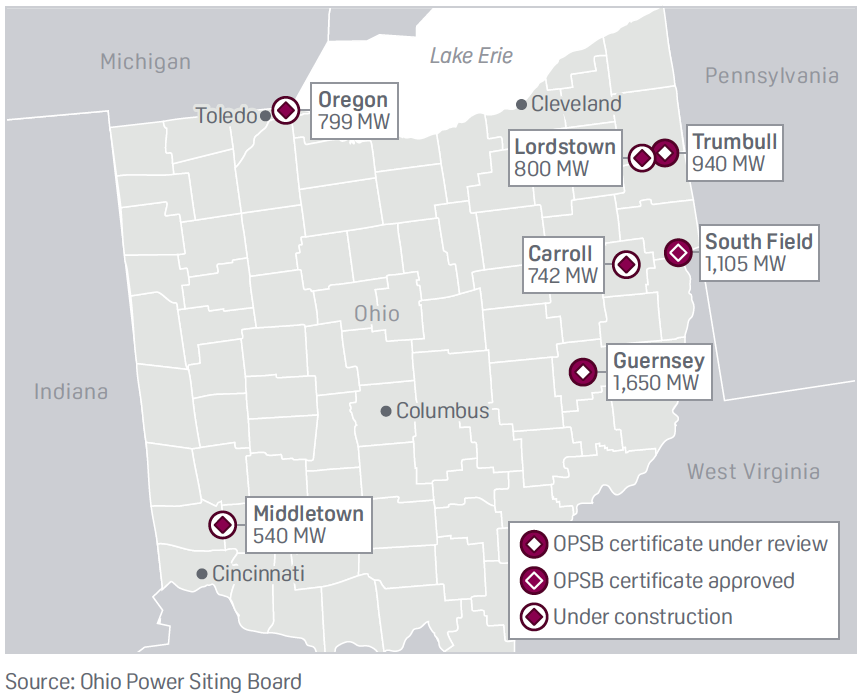

The Ohio Public Utilities Commission officially counts eight gas plant projects in the state, although a couple of others have been publicly announced but no formal applications have yet been filed, according to PUC spokesman Matt Schilling.

If all of the plants actually get built, they will represent more than 10,000 MW of new gas-fired generation.

According to Martin, there really is "no broad market" in PJM. Instead, there are "specific niches that are driven by needs of that particular niche. And my thought about PJM is that it's a heat rate market and there's certain pockets of that market that are vital and other parts of that market that might be challenged. I don't think you can look at it as a homogeneous market."

That is why he is confident that more gas-fired generation remains to be constructed in PJM, assuming, of course, that state legislators

and/or regulators do not prop up uneconomic coal and nuclear plants with special power purchase agreements.

Nuclear, coal subsidy bills' future doubted

In Ohio, FirstEnergy and American Electric Power separately are pushing bills in the General Assembly to extend an economic lifeline to aging nuclear and coal plants, respectively. The legislation is meeting with strong pushback and its fate is uncertain as lawmakers prepare to break for the summer.

Martin doubts FirstEnergy and AEP will be successful.

"The counter-argument has been made," he said. "Legislators have been informed almost on a one-to-one basis. It's very hard to see how people committed to reliability, proper business practices, and the ratepayer — anyone faithful to those principles — can approve a long-term PPA."

Paul Patterson, a Glenrock Associates analyst in New York, said in a Tuesday email he agrees that new combined-cycle gas generation

continues to have a bright upside in the region "if these market conditions persist and efforts to keep nuclear and coal plants from retiring fail."

However, if those efforts prove successful, "that could limit opportunities for new gas-powered plants," he added.

To make things more complicated, Patterson suggested, "one might consider a scenario where PJM and [the US Federal Energy Regulatory Commission] implement more so-called 'market-based' rules designed to raise wholesale power prices, ostensibly to offset the price impact of policies to keep nuclear and coal plants from closing."

Under such a scenario, Patterson said "it would seem there may be additional incentives for more gas-fired development."

-Bob Matyi